svsim is used to produce realizations of a stochastic volatility (SV)

process.

svsim(len, mu = -10, phi = 0.98, sigma = 0.2, nu = Inf, rho = 0)Arguments

- len

length of the simulated time series.

- mu

level of the latent log-volatility AR(1) process. The defaults value is

-10.- phi

persistence of the latent log-volatility AR(1) process. The default value is

0.98.- sigma

volatility of the latent log-volatility AR(1) process. The default value is

0.2.- nu

degrees-of-freedom for the conditional innovations distribution. The default value is

Inf, corresponding to standard normal conditional innovations.- rho

correlation between the observation and the increment of the log-volatility. The default value is

0, corresponding to the basic SV model with symmetric “log-returns”.

Value

The output is a list object of class svsim containing

- y

vector of length

lencontaining the simulated data, usually interpreted as “log-returns”.- vol

vector of length

lencontaining the simulated instantaneous volatilities. These are \(e^{h_t/2}\) ifnu == Inf, and they are \(e^{h_t/2} \sqrt{\tau_t}\) for finitenu.- vol0

The initial volatility

exp(h_0/2), drawn from the stationary distribution of the latent AR(1) process.- para

a named list with five elements

mu,phi,sigma,nu, andrho, containing the corresponding arguments.- latent

vector of the latent state space \(h_t\) for \(t > 0\).

- latent0

initial element of the latent state space \(h_0\).

- tau

vector of length

lencontaining the simulated auxiliary variables for the Student-t residuals whennuis finite. More precisely, \(\tau_t\sim\text{Gamma}^{-1}(\text{shape}=\nu/2, \text{rate}=\nu/2-1)\).

Details

This function draws an initial log-volatility h_0 from the stationary

distribution of the AR(1) process defined by phi, sigma, and mu.

Then the function jointly simulates the log-volatility series

h_1,...,h_n with the given AR(1) structure, and the “log-return” series

y_1,...,y_n with mean 0 and standard deviation exp(h/2).

Additionally, for each index i, y_i can be set to have a conditionally heavy-tailed

residual (through nu) and/or to be correlated with (h_{i+1}-h_i)

(through rho, the so-called leverage effect, resulting in asymmetric “log-returns”).

Note

The function generates the “log-returns” by

y <- exp(-h/2)*rt(h, df=nu). That means that in the case of nu < Inf

the (conditional) volatility is sqrt(nu/(nu-2))*exp(h/2), and that corrected value

is shown in the print, summary and plot methods.

To display the output use print, summary and plot. The

print method simply prints the content of the object in a moderately

formatted manner. The summary method provides some summary statistics

(in %), and the plot method plots the the simulated 'log-returns'

y along with the corresponding volatilities vol.

See also

Examples

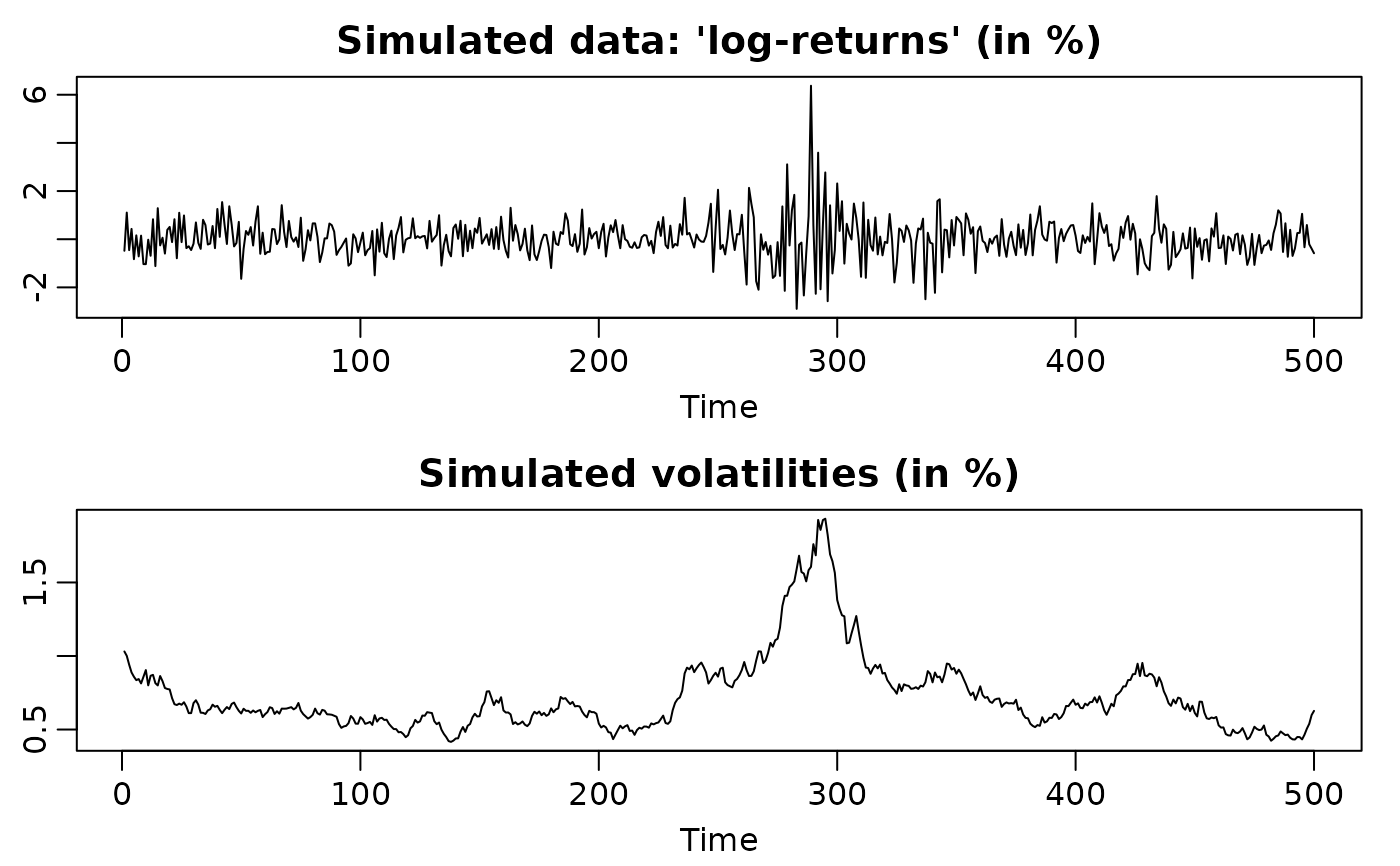

## Simulate a highly persistent SV process of length 500

sim <- svsim(500, phi = 0.99, sigma = 0.1)

print(sim)

#>

#> Simulated time series consisting of 500 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.99

#> standard deviation of latent variable sigma = 0.1

#> degrees of freedom parameter nu =Inf

#> leverage effect parameter rho =0

#>

#> Simulated initial volatility:

#>

#> Simulated volatilities:

#> [1] 0.015907069 0.016193497 0.017179078 0.016866800 0.015833470 0.015842958

#> [7] 0.016825366 0.017735585 0.018833324 0.019691748 0.020804049 0.020911755

#> [13] 0.019121696 0.019056433 0.019873982 0.020637770 0.019461271 0.019649044

#> [19] 0.018832389 0.018654884 0.017243205 0.016866332 0.017323483 0.016657508

#> [25] 0.017504286 0.018505460 0.017247198 0.017700566 0.018778357 0.017003188

#> [31] 0.016683387 0.016841123 0.017746707 0.017742363 0.017148342 0.016940584

#> [37] 0.015315130 0.014858431 0.015074745 0.013743255 0.014223835 0.013876409

#> [43] 0.011984397 0.011688812 0.012572206 0.013212553 0.011987267 0.011636264

#> [49] 0.010952586 0.011139929 0.010347756 0.010946268 0.010780958 0.010750832

#> [55] 0.010725502 0.009866819 0.009540662 0.009614348 0.009471144 0.009504632

#> [61] 0.009815671 0.010459158 0.010664889 0.010223718 0.010195123 0.009820834

#> [67] 0.009618836 0.009147073 0.009550042 0.010111706 0.010268613 0.009971045

#> [73] 0.010460348 0.010681344 0.011227781 0.011376839 0.010886376 0.009914172

#> [79] 0.009429624 0.009358801 0.009005871 0.009234405 0.009473038 0.009337662

#> [85] 0.009371118 0.009360765 0.009008895 0.009089946 0.008658796 0.008266164

#> [91] 0.008980955 0.009370295 0.008994249 0.008573450 0.009003462 0.009821916

#> [97] 0.009316496 0.009303706 0.008814199 0.009085555

#> [ reached 'max' / getOption("max.print") -- omitted 400 entries ]

#>

#> Simulated data (usually interpreted as 'log-returns'):

#> [1] -3.969030e-03 -1.215136e-02 -2.706969e-03 -2.374154e-02 -7.290831e-03

#> [6] 1.046361e-02 1.794292e-02 5.212101e-02 -6.175532e-03 3.533751e-02

#> [11] 1.605891e-02 -1.021839e-02 -1.242957e-02 -2.476756e-02 -3.517744e-03

#> [16] -1.495995e-02 -1.755270e-02 -3.763230e-02 -1.895578e-03 1.180033e-02

#> [21] -1.858776e-02 3.087943e-04 -1.880178e-02 5.300126e-03 -6.032260e-03

#> [26] 5.349748e-03 -7.704827e-03 -5.462076e-03 -5.316698e-03 -3.614345e-02

#> [31] -4.153305e-03 7.543184e-03 4.464773e-03 1.518142e-02 3.315657e-02

#> [36] -4.142350e-02 -6.195167e-03 4.746447e-03 8.493743e-03 -9.886793e-03

#> [41] -1.148955e-02 2.115346e-03 2.654128e-02 1.994909e-03 1.121060e-02

#> [46] 2.440846e-02 -1.124319e-02 1.746895e-02 2.072201e-04 -1.118960e-02

#> [51] -5.397190e-03 -5.441076e-03 -8.536594e-03 -1.396120e-02 9.030751e-05

#> [56] 8.995379e-03 1.277140e-02 -5.363889e-03 2.587980e-03 6.414431e-03

#> [61] -6.682063e-03 -1.192983e-02 -1.920092e-02 -4.221218e-03 -1.789951e-02

#> [66] -5.777159e-03 2.208995e-03 -1.482384e-02 -1.009700e-02 1.980647e-03

#> [71] 9.737758e-03 1.653016e-02 -1.494304e-02 8.712350e-04 1.553118e-03

#> [76] 1.296252e-03 -7.962888e-03 6.037010e-03 -1.310788e-02 1.093777e-02

#> [81] -8.060470e-03 4.650313e-03 9.637966e-03 -8.665575e-03 -2.699718e-03

#> [86] -4.945736e-03 -5.367568e-03 1.086371e-02 -2.116018e-03 -4.693009e-03

#> [91] 2.011409e-04 -1.094738e-02 -3.264564e-03 8.078598e-03 9.516503e-03

#> [96] 1.835326e-02 8.309279e-03 1.022609e-03 3.816490e-03 1.112855e-03

#> [ reached 'max' / getOption("max.print") -- omitted 400 entries ]

summary(sim)

#>

#> Simulated time series consisting of 500 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.99

#> standard deviation of latent variable sigma = 0.1

#> degrees of freedom parameter nu = Inf

#> leverage effect parameter rho = 0

#>

#> Simulated initial volatility (in %): 1.6412

#>

#> Summary of simulated volatilities (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> 0.5490 0.7119 0.8128 0.9117 0.9961 2.0912

#>

#> Summary of simulated data (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> -4.142351 -0.583748 -0.018901 -0.005966 0.577108 5.212101

plot(sim)

## Simulate an SV process with leverage

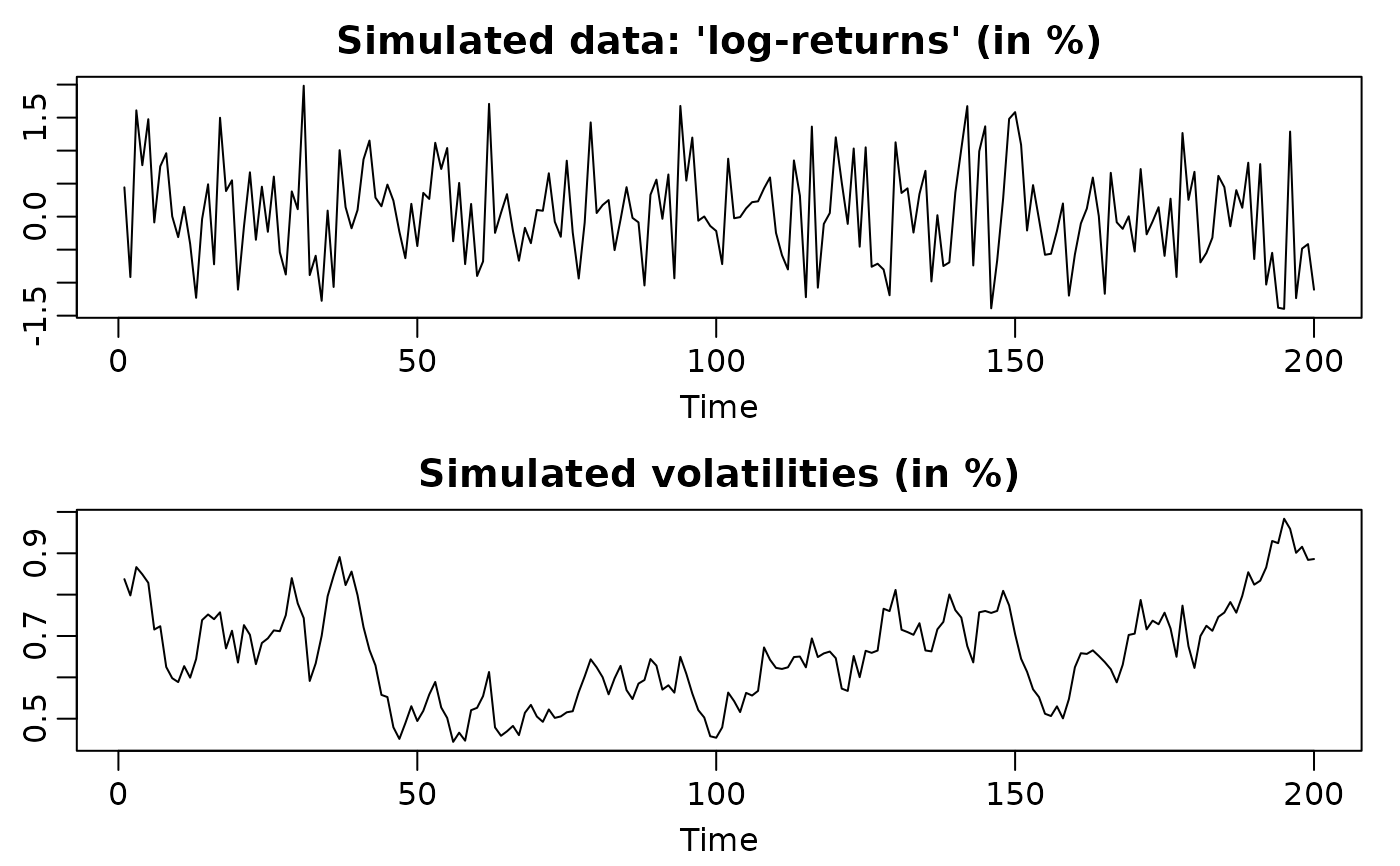

sim <- svsim(200, phi = 0.94, sigma = 0.15, rho = -0.6)

print(sim)

#>

#> Simulated time series consisting of 200 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.94

#> standard deviation of latent variable sigma = 0.15

#> degrees of freedom parameter nu =Inf

#> leverage effect parameter rho =-0.6

#>

#> Simulated initial volatility:

#>

#> Simulated volatilities:

#> [1] 0.009703500 0.010022098 0.010501716 0.008882753 0.008183094 0.007942060

#> [7] 0.007516569 0.007819044 0.007897037 0.007802039 0.008159595 0.009360950

#> [13] 0.008470274 0.008031672 0.009391579 0.008871742 0.009194121 0.009772812

#> [19] 0.008089427 0.007556203 0.007699186 0.007774771 0.007711596 0.008210184

#> [25] 0.008371405 0.009404426 0.009762090 0.008885701 0.007751540 0.007789072

#> [31] 0.007484955 0.008649647 0.008741126 0.007917881 0.007412780 0.007767126

#> [37] 0.007962480 0.008247743 0.008636282 0.009640990 0.008924358 0.009193979

#> [43] 0.008439178 0.008140419 0.007673452 0.007669002 0.008261266 0.007820852

#> [49] 0.008514471 0.008448413 0.008730144 0.008121128 0.008356181 0.008371849

#> [55] 0.008111253 0.008885874 0.009185775 0.008573316 0.008133314 0.007135916

#> [61] 0.006822723 0.006581159 0.007087249 0.006958187 0.006787221 0.006906403

#> [67] 0.007583221 0.007918690 0.008019944 0.008095877 0.008328218 0.009196445

#> [73] 0.008657464 0.008608132 0.007815417 0.008269744 0.008113261 0.008582650

#> [79] 0.007809957 0.006710307 0.007049800 0.007264336 0.007580632 0.007977967

#> [85] 0.007827850 0.007863885 0.007588011 0.007030945 0.007663257 0.007610451

#> [91] 0.008357320 0.007779638 0.007751282 0.008232950 0.009125877 0.008652853

#> [97] 0.007990447 0.008039084 0.007595469 0.007362902

#> [ reached 'max' / getOption("max.print") -- omitted 100 entries ]

#>

#> Simulated data (usually interpreted as 'log-returns'):

#> [1] 9.436547e-04 -2.360620e-02 5.903689e-03 8.579462e-03 3.542240e-03

#> [6] 2.380605e-03 -6.239023e-03 -7.515571e-04 -1.837936e-03 -1.252597e-02

#> [11] -7.835953e-03 1.815418e-02 -1.013761e-03 -1.044752e-02 1.327759e-03

#> [16] 9.569685e-03 5.213755e-03 1.812641e-02 4.410174e-04 -4.128435e-03

#> [21] -1.597301e-02 -7.823126e-03 -5.207362e-03 -9.920093e-03 -1.323487e-02

#> [26] 4.577616e-03 4.391776e-03 -5.548474e-03 -4.035377e-03 4.014632e-03

#> [31] -7.478271e-04 -2.460593e-03 1.159910e-02 1.004549e-02 1.257747e-03

#> [36] -7.304583e-03 -6.881658e-03 -2.007032e-03 -7.247942e-03 4.799292e-03

#> [41] 8.976654e-03 1.588182e-02 5.980156e-03 1.207733e-03 4.094558e-03

#> [46] -1.919329e-03 -3.408738e-04 -1.126864e-02 -7.084734e-03 -8.004682e-03

#> [51] 1.092655e-02 4.076029e-04 5.053734e-03 3.273430e-03 -1.102271e-02

#> [56] 5.652853e-04 -1.067616e-02 5.417791e-03 1.359848e-02 5.153905e-03

#> [61] 1.123964e-02 6.339751e-03 -5.283219e-03 -6.310941e-03 -4.281266e-03

#> [66] -1.356626e-02 6.542819e-03 -6.995614e-03 -6.585203e-04 1.820212e-04

#> [71] 1.572947e-04 9.714666e-04 -1.228683e-02 1.840981e-02 8.644541e-03

#> [76] -1.053495e-02 1.042914e-02 -2.990235e-03 1.921724e-02 -5.019629e-03

#> [81] 2.668696e-03 -3.636292e-03 -5.809581e-03 -8.453075e-03 -9.982781e-03

#> [86] -3.618157e-03 -4.300613e-03 -2.429510e-03 4.209342e-05 -2.889963e-03

#> [91] 3.377921e-05 5.366702e-03 -7.045191e-03 -4.675417e-03 7.943945e-03

#> [96] 1.372171e-02 -7.427816e-04 -6.042386e-03 7.623050e-03 -3.982789e-03

#> [ reached 'max' / getOption("max.print") -- omitted 100 entries ]

summary(sim)

#>

#> Simulated time series consisting of 200 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.94

#> standard deviation of latent variable sigma = 0.15

#> degrees of freedom parameter nu = Inf

#> leverage effect parameter rho = -0.6

#>

#> Simulated initial volatility (in %): 0.9949426

#>

#> Summary of simulated volatilities (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> 0.5375 0.7485 0.8104 0.8141 0.8854 1.1188

#>

#> Summary of simulated data (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> -2.81587 -0.67627 -0.07965 -0.09634 0.48629 2.05180

plot(sim)

## Simulate an SV process with leverage

sim <- svsim(200, phi = 0.94, sigma = 0.15, rho = -0.6)

print(sim)

#>

#> Simulated time series consisting of 200 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.94

#> standard deviation of latent variable sigma = 0.15

#> degrees of freedom parameter nu =Inf

#> leverage effect parameter rho =-0.6

#>

#> Simulated initial volatility:

#>

#> Simulated volatilities:

#> [1] 0.009703500 0.010022098 0.010501716 0.008882753 0.008183094 0.007942060

#> [7] 0.007516569 0.007819044 0.007897037 0.007802039 0.008159595 0.009360950

#> [13] 0.008470274 0.008031672 0.009391579 0.008871742 0.009194121 0.009772812

#> [19] 0.008089427 0.007556203 0.007699186 0.007774771 0.007711596 0.008210184

#> [25] 0.008371405 0.009404426 0.009762090 0.008885701 0.007751540 0.007789072

#> [31] 0.007484955 0.008649647 0.008741126 0.007917881 0.007412780 0.007767126

#> [37] 0.007962480 0.008247743 0.008636282 0.009640990 0.008924358 0.009193979

#> [43] 0.008439178 0.008140419 0.007673452 0.007669002 0.008261266 0.007820852

#> [49] 0.008514471 0.008448413 0.008730144 0.008121128 0.008356181 0.008371849

#> [55] 0.008111253 0.008885874 0.009185775 0.008573316 0.008133314 0.007135916

#> [61] 0.006822723 0.006581159 0.007087249 0.006958187 0.006787221 0.006906403

#> [67] 0.007583221 0.007918690 0.008019944 0.008095877 0.008328218 0.009196445

#> [73] 0.008657464 0.008608132 0.007815417 0.008269744 0.008113261 0.008582650

#> [79] 0.007809957 0.006710307 0.007049800 0.007264336 0.007580632 0.007977967

#> [85] 0.007827850 0.007863885 0.007588011 0.007030945 0.007663257 0.007610451

#> [91] 0.008357320 0.007779638 0.007751282 0.008232950 0.009125877 0.008652853

#> [97] 0.007990447 0.008039084 0.007595469 0.007362902

#> [ reached 'max' / getOption("max.print") -- omitted 100 entries ]

#>

#> Simulated data (usually interpreted as 'log-returns'):

#> [1] 9.436547e-04 -2.360620e-02 5.903689e-03 8.579462e-03 3.542240e-03

#> [6] 2.380605e-03 -6.239023e-03 -7.515571e-04 -1.837936e-03 -1.252597e-02

#> [11] -7.835953e-03 1.815418e-02 -1.013761e-03 -1.044752e-02 1.327759e-03

#> [16] 9.569685e-03 5.213755e-03 1.812641e-02 4.410174e-04 -4.128435e-03

#> [21] -1.597301e-02 -7.823126e-03 -5.207362e-03 -9.920093e-03 -1.323487e-02

#> [26] 4.577616e-03 4.391776e-03 -5.548474e-03 -4.035377e-03 4.014632e-03

#> [31] -7.478271e-04 -2.460593e-03 1.159910e-02 1.004549e-02 1.257747e-03

#> [36] -7.304583e-03 -6.881658e-03 -2.007032e-03 -7.247942e-03 4.799292e-03

#> [41] 8.976654e-03 1.588182e-02 5.980156e-03 1.207733e-03 4.094558e-03

#> [46] -1.919329e-03 -3.408738e-04 -1.126864e-02 -7.084734e-03 -8.004682e-03

#> [51] 1.092655e-02 4.076029e-04 5.053734e-03 3.273430e-03 -1.102271e-02

#> [56] 5.652853e-04 -1.067616e-02 5.417791e-03 1.359848e-02 5.153905e-03

#> [61] 1.123964e-02 6.339751e-03 -5.283219e-03 -6.310941e-03 -4.281266e-03

#> [66] -1.356626e-02 6.542819e-03 -6.995614e-03 -6.585203e-04 1.820212e-04

#> [71] 1.572947e-04 9.714666e-04 -1.228683e-02 1.840981e-02 8.644541e-03

#> [76] -1.053495e-02 1.042914e-02 -2.990235e-03 1.921724e-02 -5.019629e-03

#> [81] 2.668696e-03 -3.636292e-03 -5.809581e-03 -8.453075e-03 -9.982781e-03

#> [86] -3.618157e-03 -4.300613e-03 -2.429510e-03 4.209342e-05 -2.889963e-03

#> [91] 3.377921e-05 5.366702e-03 -7.045191e-03 -4.675417e-03 7.943945e-03

#> [96] 1.372171e-02 -7.427816e-04 -6.042386e-03 7.623050e-03 -3.982789e-03

#> [ reached 'max' / getOption("max.print") -- omitted 100 entries ]

summary(sim)

#>

#> Simulated time series consisting of 200 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.94

#> standard deviation of latent variable sigma = 0.15

#> degrees of freedom parameter nu = Inf

#> leverage effect parameter rho = -0.6

#>

#> Simulated initial volatility (in %): 0.9949426

#>

#> Summary of simulated volatilities (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> 0.5375 0.7485 0.8104 0.8141 0.8854 1.1188

#>

#> Summary of simulated data (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> -2.81587 -0.67627 -0.07965 -0.09634 0.48629 2.05180

plot(sim)

## Simulate an SV process with conditionally heavy-tails

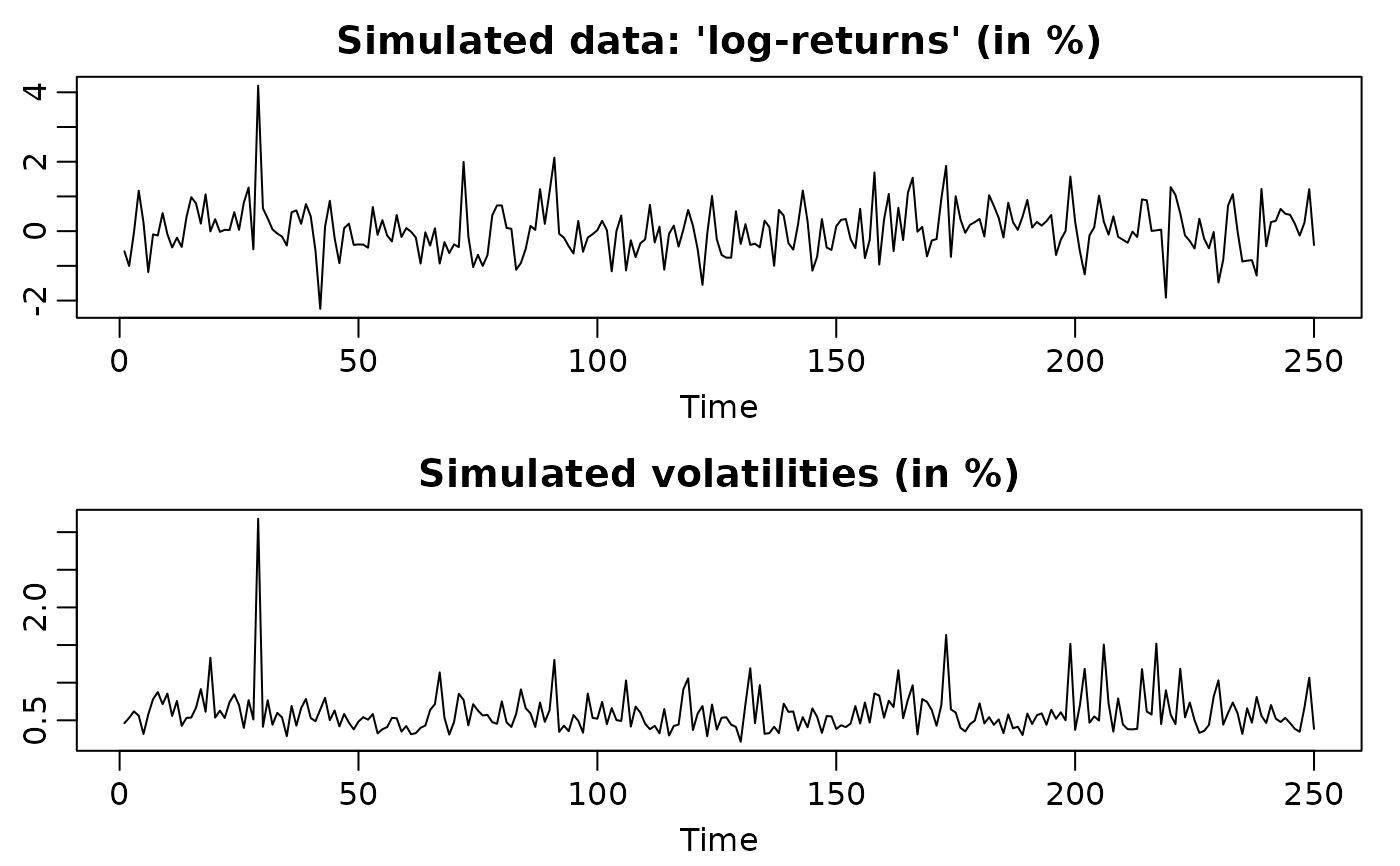

sim <- svsim(250, phi = 0.91, sigma = 0.05, nu = 5)

print(sim)

#>

#> Simulated time series consisting of 250 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.91

#> standard deviation of latent variable sigma = 0.05

#> degrees of freedom parameter nu =5

#> leverage effect parameter rho =0

#>

#> Simulated initial volatility:

#>

#> Simulated volatilities:

#> [1] 0.007117304 0.003124488 0.004099299 0.006894685 0.003398688 0.004263595

#> [7] 0.004122176 0.004513049 0.004788633 0.004554743 0.009622520 0.006077362

#> [13] 0.003548397 0.008747726 0.005504351 0.004424414 0.005798857 0.004911596

#> [19] 0.005147055 0.004338344 0.007084922 0.004598163 0.004613729 0.005144067

#> [25] 0.005803849 0.005333018 0.004468676 0.013496884 0.004062223 0.003476179

#> [31] 0.005424856 0.004258867 0.003363024 0.003984611 0.003526481 0.006103780

#> [37] 0.005961445 0.008764194 0.004306725 0.009634816 0.018578918 0.003888194

#> [43] 0.005096594 0.007794913 0.005265252 0.004708854 0.005852598 0.010273163

#> [49] 0.009495415 0.010638201 0.003680086 0.005832722 0.005314855 0.004614270

#> [55] 0.004059608 0.003331623 0.004206021 0.004490159 0.003587506 0.006015633

#> [61] 0.003742721 0.004783929 0.004428409 0.004708123 0.008279515 0.008322414

#> [67] 0.006129627 0.005151068 0.003701416 0.003673100 0.005775463 0.005499252

#> [73] 0.006740831 0.004618683 0.012584694 0.003608858 0.005932499 0.008801510

#> [79] 0.007950287 0.008358306 0.007657283 0.004097484 0.005319485 0.003985723

#> [85] 0.008957878 0.007721676 0.008349785 0.008042774 0.003890334 0.003960035

#> [91] 0.002881378 0.004664967 0.005983061 0.004224835 0.004575135 0.004992448

#> [97] 0.004200940 0.006820723 0.006228872 0.010929963

#> [ reached 'max' / getOption("max.print") -- omitted 150 entries ]

#>

#> Simulated data (usually interpreted as 'log-returns'):

#> [1] 1.221232e-02 -1.712724e-03 -4.378564e-03 1.484838e-03 -1.834531e-03

#> [6] 3.913578e-03 7.306117e-03 5.451776e-03 -2.638818e-03 -1.668017e-03

#> [11] -9.495726e-03 -6.869796e-03 -3.206065e-03 1.191037e-03 -5.849334e-03

#> [16] -6.564598e-04 -5.656470e-04 -4.020850e-03 6.154094e-03 -9.224553e-03

#> [21] 9.735579e-03 5.695014e-04 5.457701e-04 1.203832e-03 -9.404973e-03

#> [26] 4.307254e-04 1.847334e-03 5.399886e-03 -4.950877e-03 -1.124842e-03

#> [31] 8.829133e-03 -5.091649e-03 -2.643414e-04 9.226418e-04 -7.469575e-04

#> [36] -1.468715e-03 -8.994753e-03 -5.194405e-03 -1.443015e-03 5.120418e-03

#> [41] -2.783532e-02 -2.408150e-03 -3.615306e-03 2.794873e-03 -5.603209e-04

#> [46] 1.348216e-03 -1.114131e-02 -3.447357e-03 -3.041226e-03 -4.963826e-03

#> [51] 9.706121e-04 4.880160e-04 -4.817528e-03 2.983846e-03 2.785203e-03

#> [56] -1.179717e-03 -1.257322e-03 6.196002e-03 4.284977e-03 -9.693352e-03

#> [61] -1.350533e-03 -5.656021e-04 3.985322e-03 -3.368650e-03 -1.429626e-03

#> [66] 2.317280e-03 -4.048001e-03 -6.046355e-03 7.748354e-05 -1.951043e-03

#> [71] -1.427238e-03 -1.099385e-02 -5.297270e-03 8.980021e-03 2.031050e-02

#> [76] -2.717464e-03 1.383248e-02 -6.890779e-03 -1.062643e-03 1.352003e-03

#> [81] 2.751582e-04 2.431401e-04 4.522979e-04 -2.567620e-03 1.601748e-02

#> [86] 1.574892e-02 8.972956e-03 -5.121634e-03 -1.897857e-03 -9.320091e-03

#> [91] -1.135918e-03 -4.829697e-03 1.887612e-03 2.275794e-03 -4.510480e-03

#> [96] -4.778371e-03 2.904833e-04 1.077729e-02 1.972570e-03 -8.639840e-03

#> [ reached 'max' / getOption("max.print") -- omitted 150 entries ]

summary(sim)

#>

#> Simulated time series consisting of 250 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.91

#> standard deviation of latent variable sigma = 0.05

#> degrees of freedom parameter nu = 5

#> leverage effect parameter rho = 0

#>

#> Simulated initial volatility (in %): 0.6380607

#>

#> Summary of simulated volatilities (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> 0.2881 0.4498 0.5596 0.6382 0.7421 3.7613

#>

#> Summary of simulated data (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> -2.783532 -0.399493 -0.026350 0.004763 0.370979 2.576650

plot(sim)

## Simulate an SV process with conditionally heavy-tails

sim <- svsim(250, phi = 0.91, sigma = 0.05, nu = 5)

print(sim)

#>

#> Simulated time series consisting of 250 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.91

#> standard deviation of latent variable sigma = 0.05

#> degrees of freedom parameter nu =5

#> leverage effect parameter rho =0

#>

#> Simulated initial volatility:

#>

#> Simulated volatilities:

#> [1] 0.007117304 0.003124488 0.004099299 0.006894685 0.003398688 0.004263595

#> [7] 0.004122176 0.004513049 0.004788633 0.004554743 0.009622520 0.006077362

#> [13] 0.003548397 0.008747726 0.005504351 0.004424414 0.005798857 0.004911596

#> [19] 0.005147055 0.004338344 0.007084922 0.004598163 0.004613729 0.005144067

#> [25] 0.005803849 0.005333018 0.004468676 0.013496884 0.004062223 0.003476179

#> [31] 0.005424856 0.004258867 0.003363024 0.003984611 0.003526481 0.006103780

#> [37] 0.005961445 0.008764194 0.004306725 0.009634816 0.018578918 0.003888194

#> [43] 0.005096594 0.007794913 0.005265252 0.004708854 0.005852598 0.010273163

#> [49] 0.009495415 0.010638201 0.003680086 0.005832722 0.005314855 0.004614270

#> [55] 0.004059608 0.003331623 0.004206021 0.004490159 0.003587506 0.006015633

#> [61] 0.003742721 0.004783929 0.004428409 0.004708123 0.008279515 0.008322414

#> [67] 0.006129627 0.005151068 0.003701416 0.003673100 0.005775463 0.005499252

#> [73] 0.006740831 0.004618683 0.012584694 0.003608858 0.005932499 0.008801510

#> [79] 0.007950287 0.008358306 0.007657283 0.004097484 0.005319485 0.003985723

#> [85] 0.008957878 0.007721676 0.008349785 0.008042774 0.003890334 0.003960035

#> [91] 0.002881378 0.004664967 0.005983061 0.004224835 0.004575135 0.004992448

#> [97] 0.004200940 0.006820723 0.006228872 0.010929963

#> [ reached 'max' / getOption("max.print") -- omitted 150 entries ]

#>

#> Simulated data (usually interpreted as 'log-returns'):

#> [1] 1.221232e-02 -1.712724e-03 -4.378564e-03 1.484838e-03 -1.834531e-03

#> [6] 3.913578e-03 7.306117e-03 5.451776e-03 -2.638818e-03 -1.668017e-03

#> [11] -9.495726e-03 -6.869796e-03 -3.206065e-03 1.191037e-03 -5.849334e-03

#> [16] -6.564598e-04 -5.656470e-04 -4.020850e-03 6.154094e-03 -9.224553e-03

#> [21] 9.735579e-03 5.695014e-04 5.457701e-04 1.203832e-03 -9.404973e-03

#> [26] 4.307254e-04 1.847334e-03 5.399886e-03 -4.950877e-03 -1.124842e-03

#> [31] 8.829133e-03 -5.091649e-03 -2.643414e-04 9.226418e-04 -7.469575e-04

#> [36] -1.468715e-03 -8.994753e-03 -5.194405e-03 -1.443015e-03 5.120418e-03

#> [41] -2.783532e-02 -2.408150e-03 -3.615306e-03 2.794873e-03 -5.603209e-04

#> [46] 1.348216e-03 -1.114131e-02 -3.447357e-03 -3.041226e-03 -4.963826e-03

#> [51] 9.706121e-04 4.880160e-04 -4.817528e-03 2.983846e-03 2.785203e-03

#> [56] -1.179717e-03 -1.257322e-03 6.196002e-03 4.284977e-03 -9.693352e-03

#> [61] -1.350533e-03 -5.656021e-04 3.985322e-03 -3.368650e-03 -1.429626e-03

#> [66] 2.317280e-03 -4.048001e-03 -6.046355e-03 7.748354e-05 -1.951043e-03

#> [71] -1.427238e-03 -1.099385e-02 -5.297270e-03 8.980021e-03 2.031050e-02

#> [76] -2.717464e-03 1.383248e-02 -6.890779e-03 -1.062643e-03 1.352003e-03

#> [81] 2.751582e-04 2.431401e-04 4.522979e-04 -2.567620e-03 1.601748e-02

#> [86] 1.574892e-02 8.972956e-03 -5.121634e-03 -1.897857e-03 -9.320091e-03

#> [91] -1.135918e-03 -4.829697e-03 1.887612e-03 2.275794e-03 -4.510480e-03

#> [96] -4.778371e-03 2.904833e-04 1.077729e-02 1.972570e-03 -8.639840e-03

#> [ reached 'max' / getOption("max.print") -- omitted 150 entries ]

summary(sim)

#>

#> Simulated time series consisting of 250 observations.

#>

#> Parameters: level of latent variable mu = -10

#> persistence of latent variable phi = 0.91

#> standard deviation of latent variable sigma = 0.05

#> degrees of freedom parameter nu = 5

#> leverage effect parameter rho = 0

#>

#> Simulated initial volatility (in %): 0.6380607

#>

#> Summary of simulated volatilities (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> 0.2881 0.4498 0.5596 0.6382 0.7421 3.7613

#>

#> Summary of simulated data (in %):

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> -2.783532 -0.399493 -0.026350 0.004763 0.370979 2.576650

plot(sim)